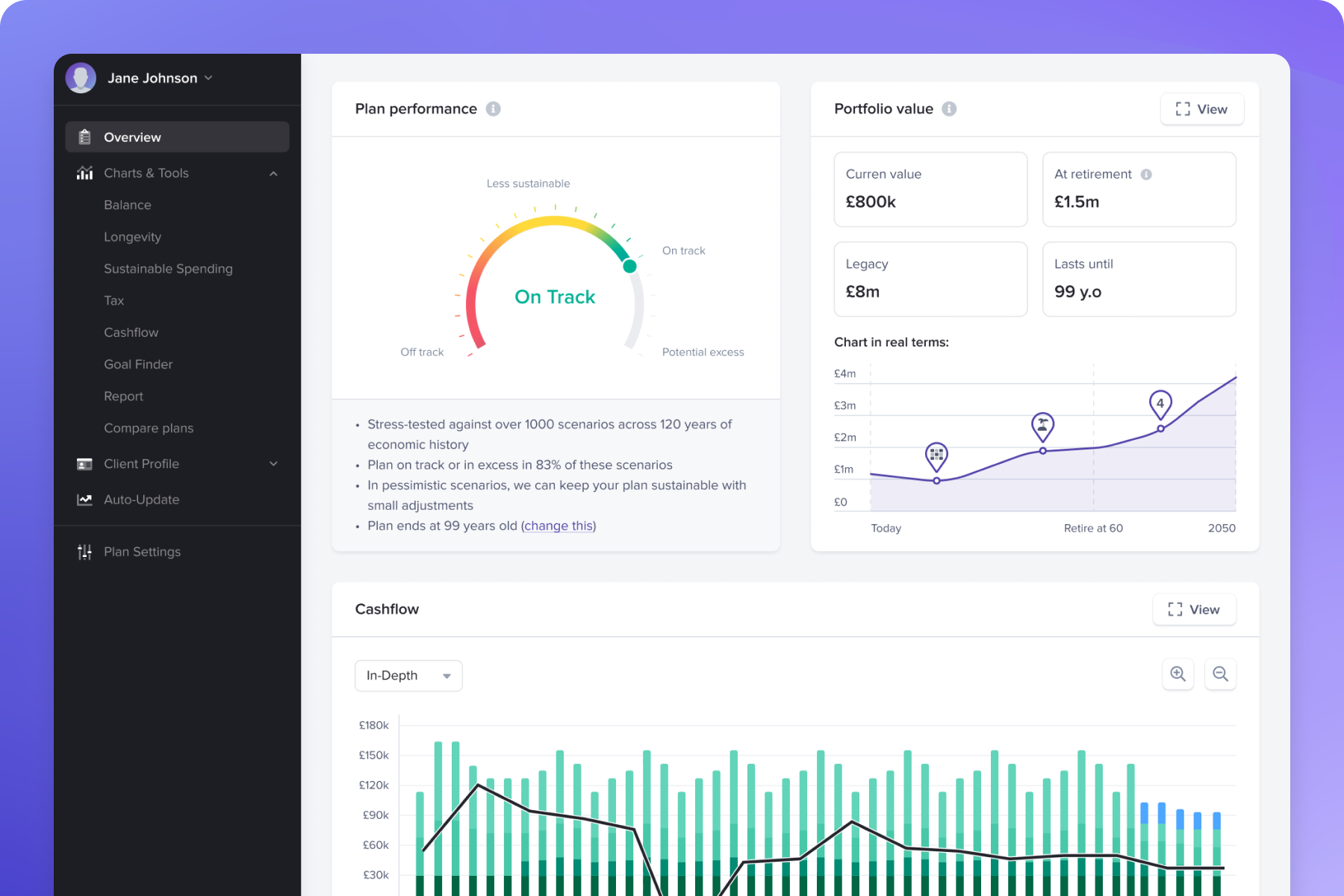

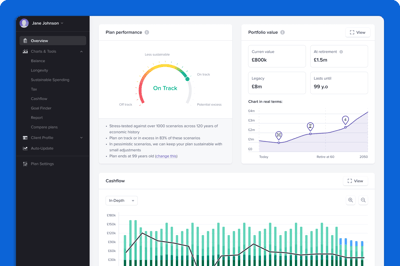

Planning

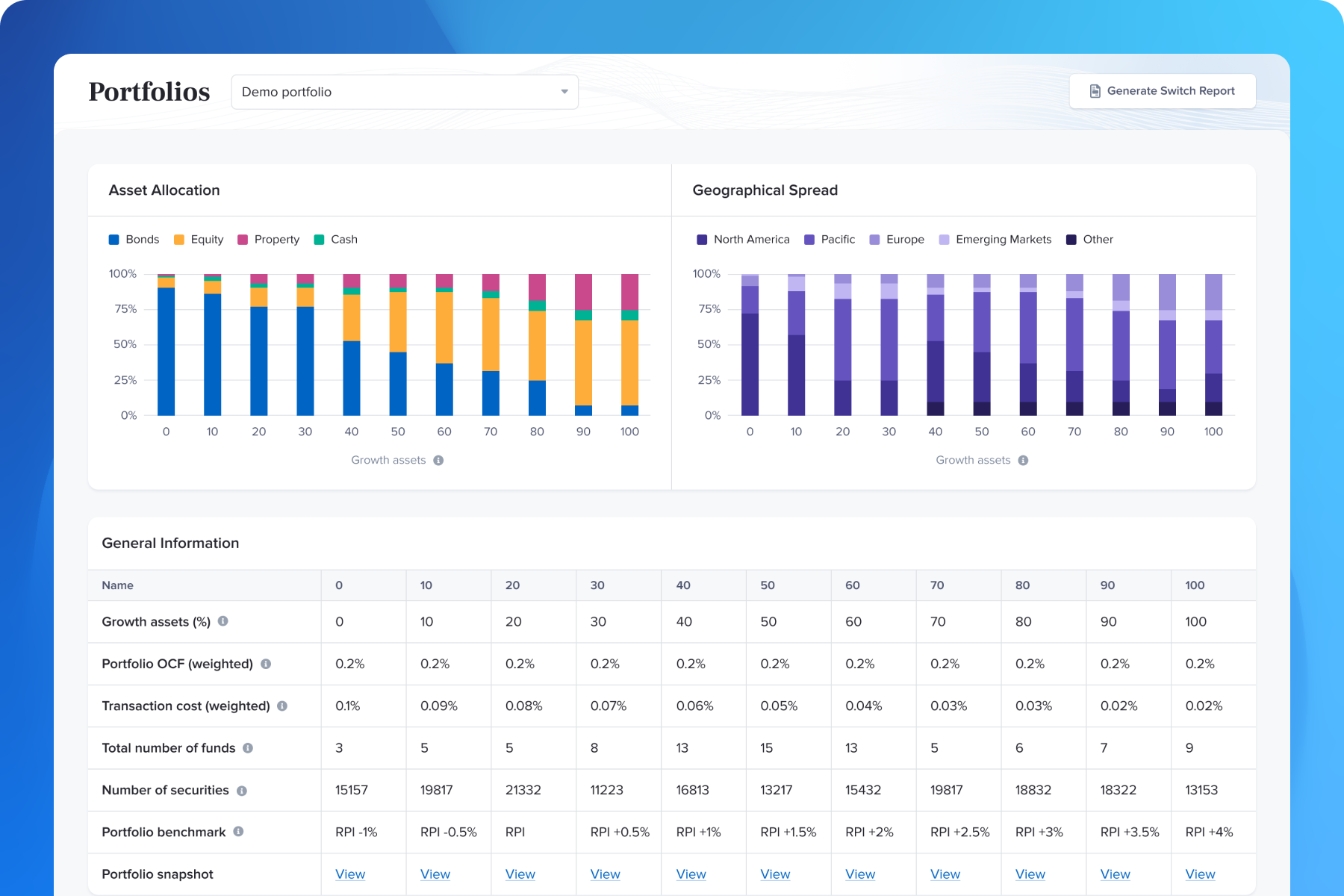

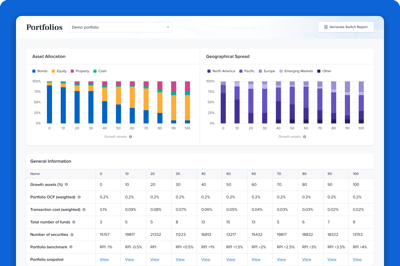

Portfolios

Adviser 3.0 - Bigger & Better for 2024!

The unmissable event for financial planners is back, join us on the 16th of May 2024.

Exclusive to financial advisers

We make financial planning easier for advisers and more engaging for clients. Financial Advisers add the most value to clients through personalised plans and coaching that gives clients clarity and confidence in their financial future. Hear the direct feedback from advisers and firms who have reaped the benefits of working with us.

Exclusive to financial advisers

We make financial planning easier for advisers and more engaging for clients. Financial Advisers add the most value to clients through personalised plans and coaching that gives clients clarity and confidence in their financial future. Hear the direct feedback from advisers and firms who have reaped the benefits of working with us.

Our model portfolios are available on

What advisers say about us

For us and our clients, it's great to have a team of individuals behind us focused on their investments - including dedicated investment analysts and investment specialists.

We have a process and an investment philosophy that we can explain and have full confidence in.

Tom Skinner - Barnaby Cecil

Timeline has blown us away. The access to fund information, adviser support software and investment technical updates has had a massive positive impact at Magenta.

Great people to work with, professional, authentic and fun.

Gretchen Betts - Magenta Financial Planning

We have been using Timeline's platform for a while now as we believe that it is the best retirement solution in the market. Timeline's constant new feature development and release strategy has really impressed us.

Matt Pitcher - Altor Wealth