With Timeline Planning you can

Show clients

their future

Drive confident decisions

Cut annual

review prep

Ensure full compliance

Link plans

to our MPS

With Timeline Planning you can

Show clients

their future

Captivate clients with powerful visualisations of their financial future built using reliable data.

Drive confident decisions

Cut annual

review prep

Ensure full

compliance

Link plans

to our MPS

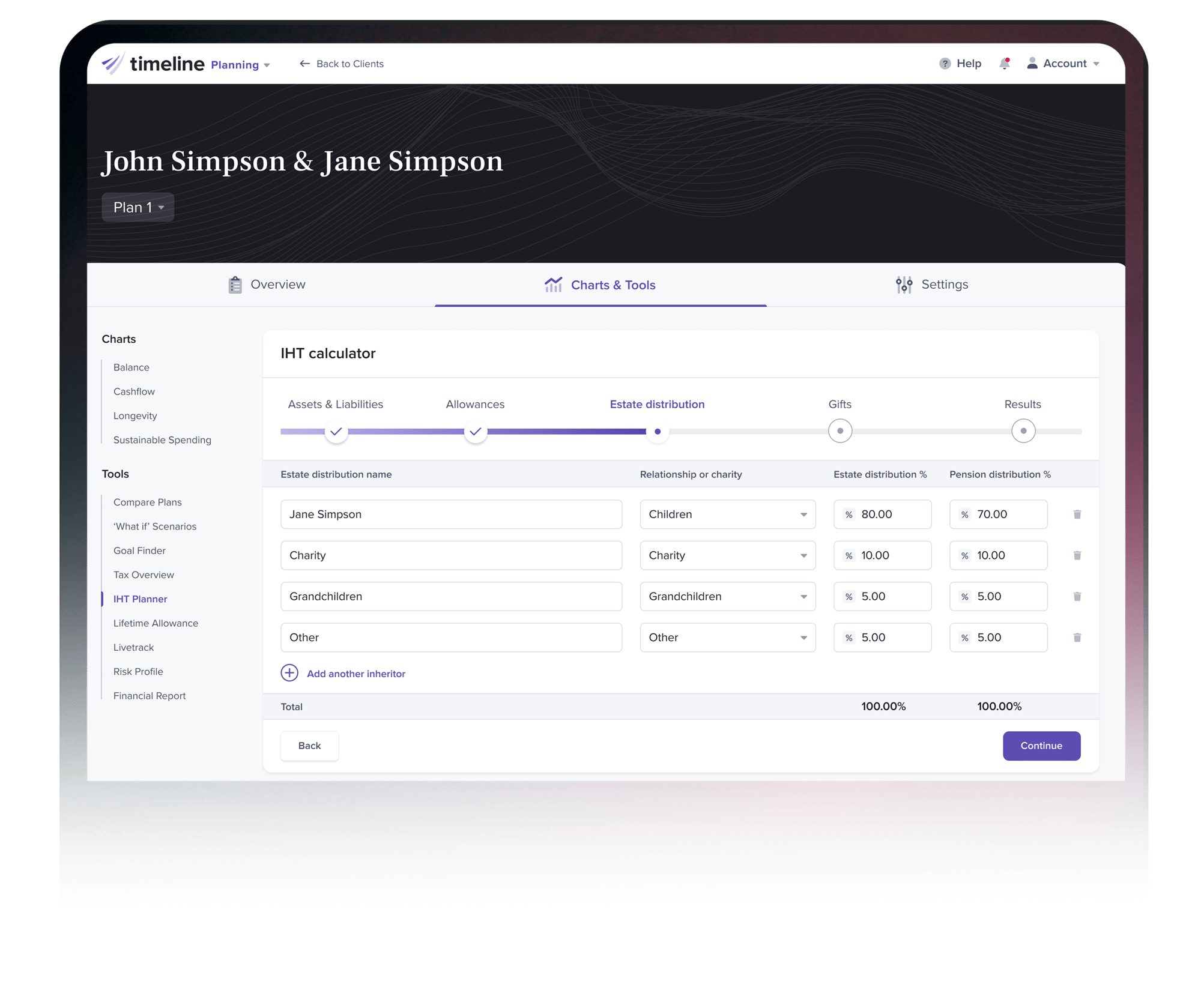

The plan leads, the portfolio follows

We're done with shoddy, outdated tech holding advisers back and stifling productivity. With Timeline, you can take your clients through factfind and risk profiling, to planning, stress-testing and then link the plan to one of our model portfolios with ease.

Give your firm the edge with a leading investment, savings and retirement proposition based on our cutting edge tech, data and methodology. It is low cost, easy to use and focused on delivering excellent client outcomes.

Factfind

Risk Profiler

Planning and modelling

Stress-testing

Investing

Monitoring & reporting

Import client data in seconds from

Here's how advisers are using it

Advisers throughout the UK are using Timeline Planning to give clients clarity, confidence and conviction with their financial plans. Here's an example of how...

Here's what advisers are saying about us

We have been using Timeline's platform for a while now as we believe that it is the best retirement solution in the market. Timeline's constant new feature development and release strategy has really impressed us.

Matt Pitcher - Altor Wealth